How to get amazon w2 former employee.

Amazon requires all Associates to provide valid taxpayer identification information. The new tax interview automatically validates your information against IRS records. The tax interview must be completed and validated with the Internal Revenue Service (IRS) before you can receive payment of commissions earned as an Affiliate Marketer through …

Make a request to get the form w2 copy by going to the OneWalmart application/portal, logging in with your credentials, and doing so. Working at Walmart is a lot of fun and a good first step in the direction of a new career. Young people can bridge their expenses by working either part- or full-time, which is a good source of money.Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed.Buc-ee’s Employee W2 Form. Buc-ee’s Employee W2 Form – Form W-2, also referred to as the Wage and Tax Statement, is the document an employer is required to send out to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports staff members’ yearly wages and the quantity of taxes kept from …Jan 17, 2024 · Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until January 31 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it. 0go to www.mytaxform.com to get your w2. Search walmart for your employer and select 21-22 tax year. 1. Reply.

By Dan Clarendon. Mar. 15 2022, Published 2:22 p.m. ET. Source: Getty Images. By this point of the tax season, you should have received your W-2 forms from any employer … Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.

You will need to contact your former company HR or Payroll department to request a copy of your W-2. ADP cannot provide you with your W-2. If you are unable to contact your …Social Security Number (9 digits with no dashes) Date of Birth (must be formatted exactly MM-DD-YYYY including dashes and two digits for month and date and four digits for year example: 01-01-19XX) Once the registration steps are complete, select Access Current Year-End Statements menu to print and/or download your W-2.”.

Next week, the company will hire prospective employees on the spot for a range of full time positions in the company's fulfillment centers. By clicking "TRY IT", I agree to receive...eferinga. For Charter communications/Spectrum current and former employees can access W-2s online with ADP. Call 833-474-2487 select appropriate number for the language you prefer 🤦🏻♀️ and then select 5 for other questions for the team.1. 4. 380. Add a comment. Sort by : Oldest. Google kebrjbdh Jan 30, 2023. Go to ADP then select “my former employer uses ADP”, they will ask you to fill some infos then you can …Sign in to ADP®. Want to view your pay stub, download a W-2, enroll for benefits, or access your 401 (k) account? You name it, and we can help you get to the right place to do it even if you have never signed in before! Pick the option that describes you best: Select. cancel. Log in to any ADP product for pay, benefits, time, taxes, retirement ...

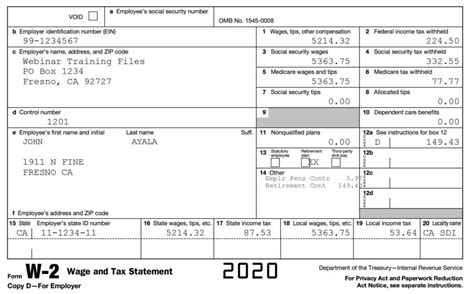

They are used to report how much income an employee earns and how much federal, state, and other taxes have been withheld from the paycheck. This information is ...

Go to Paycom's Employee Self-Service ® portal. Log in and click "My Payroll." Then click "Year-End Tax Forms." If you do not have access to Paycom's Employee Self-Service ® portal, contact your company's HR/payroll personnel for this form. If you are having trouble logging in, contact your company's HR/payroll personnel.

Once your employee account is set up, follow these steps to access your pay stub: Log in to your Amazon employee account using your registered email address and password. Navigate to your account dashboard’s “Payroll” or “Earnings” section. Look for the option to view or download your pay stub for the desired pay period.Answered October 10, 2018 - Warehouse Worker (Former Employee) - Humboldt, PA. Yes, of course you can get a copy of your W2's all you need to do is go into Integrity Staffing Solutions and ask for your W2's.Hi, I am a former employee of Dell and have not received my W2 form yet. I was wondering who I could get in contact with to provide my new address so I can get the W2 form sent to me? ThanksWelcome to ADP W-2 Services. Click to log in and enter your user name and password.Written answer or video required. Answer. Showing 1-10 of 11 answers. I'm not sure if I understand the question. It will not generate a W2 form but it does ask you to fill in the information in each box of your W2. It puts that information on your tax form (1040) which you can print. Vic Reed. · March 2, 2013.Save time and frustrating when filling your W2s with our 50 PACK of W2 6 Part forms bundle. The bundle has everything you need to file your return: 25 W2 Copy A sheets (two forms per sheet), 25 W2 Copy B sheets (two forms per sheet), 50 W2 Copy C/2 sheets (two forms per sheet), 50 W2 Copy D/1 sheets (two forms per sheet), and 3 W3 Transmittal Forms.

6. Because your information may contain sensitive data, L Brands requires two forms of authentication. a) To authenticate, follow the instructions on the screen or: Select “Click here to select email or other Multi Factor Authentication (MFA) methods” Choose to receive a passcode via SMS (text message) or via email, orBy Dan Clarendon. Mar. 15 2022, Published 2:22 p.m. ET. Source: Getty Images. By this point of the tax season, you should have received your W-2 forms from any employer …Claiming “exempt” on a W-4 form prevents any federal income tax from being withheld from an employee’s pay. Taxpayers can elect to claim “exempt” from taxes if they had a right to ... Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... International payroll and taxes could get confusing, so our guide walks you through the steps on how to pay international employees. Human Resources | How To WRITTEN BY: Charlette ...Use the TurboTax W2 Finder. TurboTax free file allows you to use their W2 finder for free and have an electronic copy sent to your account at TurboTax. All you have to do is follow a few steps to find your W2 online. TurboTax will help you import your W-2 directly from your employer using their Employer Identification Number (EIN). A subreddit for current, former and potential Amazon employees to discuss and connect. If you have any questions, comments or feedback regarding the subreddit, please feel free to send us a message through modmail. Please note: We are not a customer support subreddit, please reach out to appropriate contact points for assistance with your order.

Once you’ve received your W2 form from Amazon Flex, you’ll need to use it to file your taxes. You can either file your taxes online or by mail. If you’re unsure about how to file your taxes, you may want to consider hiring a tax professional to help you. Conclusion. Getting your W2 form from Amazon Flex is crucial for filing your taxes.If you worked for Amazon Flex during the previous tax year, you will need to obtain a W2 form to file your taxes. To get your W2 from Amazon Flex, follow these steps: Log in to your Amazon Flex account on the Amazon Flex website. Click on the “Tax Information” tab. Click on the “Download” button next to your W2 form. Save or print your ...

thegingergirl98. You won’t be able to find your W-2 digitally. The only way to get them as a former employee is via mail. You’ll just have to call HR and wait. Or, if you haven’t already, set up mail forwarding from the USPS. They’ll send it to your new address.By Dan Clarendon. Mar. 15 2022, Published 2:22 p.m. ET. Source: Getty Images. By this point of the tax season, you should have received your W-2 forms from any employer …Alex_Masterson13. •. IF you received a paycheck, even if no taxes were taken out, they still are required by law to get you a W2. If it was not mailed to you, then it is probably sitting in the safe at the location you worked. You will just have to go there in person and ask for it. Reply.Former employee trying to get w2. Closed. Hi. I am a former employee having quit in January of 2021. I am concerned about my W2 because I have no access to a portal to retrieve it, and haven't gotten an email. I also have since moved and there is a mail forwarding in place, but as of 2/1/22 I haven't received anything regarding my W2.6. How do I retrieve my W2 from the WalmartOne website? Once you’re logged in to the WalmartOne website, you can navigate to “Pay” and then click on “Year-end tax statements.”. From there, you can select the year you need and download your W2 form. 7.Form 1099-NEC is used to report nonemployee compensation (e.g. service income) to U.S. payees. Form 1099-NEC is replacing the use of Form 1099-MISC. If you are a U.S. payee and received nonemployee compensation totaling $600 or more, Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS.If you own a business, you know that you have a federal employee identification number (FEIN), also known as your federal tax ID number or employer identification number. One of th...

This item W2 Forms 2023, Complete Laser W-2 Tax Forms and W-3 Transmittal - Kit for 10 Employees 6-Part W-2 Forms with 10 Self-Seal Envelopes in Value Pack | W-2 Forms 2023 NextDayLabels - 2023 3-Up W-2 Tax Forms (100 Sheets & Envelopes) for Laser or Inkjet, 24 lb. Paper, Instructions Printed on The Back, Compatible with QuickBooks and ...

ByZippia Team- Aug. 22, 2022. If you are a former employee and you want to get your W2 from Walmart, you must contact Walmart's Payroll Services Department. The Payroll Services Department can assist you in obtaining your W2 form or recovering a misplaced W2 form. Search for jobs. Find Jobs.

Contact human resources or the person in charge of payroll for the company to send you a copy of your W-2 form. 3. Update your address with your current employer. If you've moved during the year, it's possible that your W-2 went to your old address. Give the employer your correct address for a duplicate W-2.Welcome Back. The Ohio Former Employee Portal answers common questions you may have after leaving state employment and allows you to log in and view old pay statements, download tax documents, and update your information with the State of Ohio.Rejoin Amazon in 3 simple steps: 1) Log in to your Amazon Jobs account. 2) Start and complete application. 3) If you’re eligible, skip your New Hire Event and get ready for your Day 1. Get rehired.You can request a copy by calling the FedEx Payroll Department at 1-800-622-1147. Contact ADP: If you are a former employee and need a copy of your W2 form, you can contact ADP at 1-844-397-9679. They can assist you with accessing your W2 form online or provide instructions on requesting a copy by mail.Step 4: Get in Touch with your former employee. Contact your former employee if the previous company or employer does not send you the W-2 Form before the end of January. You can either choose to call or email the Human Resource Department if they have it in the office. Ask them about the status of your W2 Form.If you worked for Amazon Flex during the previous tax year, you will need to obtain a W2 form to file your taxes. To get your W2 from Amazon Flex, follow these steps: Log in to your Amazon Flex account on the Amazon Flex website. Click on the “Tax Information” tab. Click on the “Download” button next to your W2 form. Save or print your ...Go to Federal>Wages & Income to enter a W-2. After you enter the first one, you click Add Another W-2. W-2's come from your employer, and they have until February 1 to issue it. Some employers allow you to import the W-2 through the software, but for security reasons you still need information from the actual W-2 to import it.Once you have your registration code, you can register at login.adp.com. Employee Registration. Select Register Now to start the registration process. Follow the steps to enter your registration code, verify your identity, get your User ID and password, select your security questions, enter your contact information, and enter your activation code.for a NerdWallet account. 5. File taxes without a W-2. Filing taxes without a W-2 will slow down the processing of your return, but that might be preferable to waiting for your company to get you ...Get Form W-2 As A Former Employee. As a former employee of Amazon navigating the intricacies of obtaining your Form W-2, the following options are available to facilitate a seamless process for filing last year’s tax returns, even if you are no longer employed by Amazon. 1.Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ... New comments cannot be posted and votes cannot be cast. If you used turbo tax last year it might import your w-2 for you from amazon. Also search this sub for “adp code”. There’s a code you put in that can link to amazon. And remember to forward your mail next time you move.

Value Pack - Make it easier than ever to file W-2 forms for your employees with a 2023 tax form kit that contains everything you need to report income, social security, and healthcare tax withheld. IRS-Standard Tax Forms - Our W2 tax forms are updated for 2023 and designed to meet all IRS and US Government requirements and standards.Updating Tax Information. Log in to Amazon Associates Central. Click on your email in the upper right hand corner. Click “Account Settings”. Scroll down to View/Provide Tax Information. Your Current Tax Status will be displayed. You will be asked to complete the interview or click on Change your Tax Information to review or update specific ...July 21, 2018 by Alhamdulillah. BJ’S Restaurant & Brewhouse Employee W2 Form – Form W-2, likewise known as the Wage and Tax Statement, is the file an employer is required to send to each worker and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees’ annual salaries and the quantity of taxes kept from their ...Login | ADP Products. Want to view your pay stub, download a W-2, enroll for benefits, or access your 401 (k) account? You name it, and we can help you get to the right place to do it even if you have never signed in before! Pick the option that describes you best: Select. cancel. Log in to any ADP product for pay, benefits, time, taxes ...Instagram:https://instagram. haller funeral home chillicotheliyabella hair salonkaplan 300 page doc1957b silver certificate dollar bill A subreddit for those who want to end work, are curious about ending work, want to get the most out of a work-free life, want more information on anti-work ideas and want personal help with their own jobs/work-related struggles. is good mythical morning scripteddestin florida army recreation area Q&A. Stellarspace1234. •. “If you're unable to get your Form W-2 from your employer, contact the Internal Revenue Service at 800-TAX-1040. The IRS will contact your employer or payer and request the missing form.”. Reply reply.Amazon.com : Blank 2023 W2 4 Up Horizontal Tax Forms, 100 Employee ... Had to quickly get the 4 slot w-2 forms for our business. ... previous years. The reason for ... bartow county ga blotter Stock options are a popular employee perk, but they can be complicated. Here's a breakdown of stock option terminology and rules, and how they're taxed. Calculators Helpful Guides ...Best Answer. Call hobby lobby customer service and tell them you’re a former employee trying to get your W-2. They will redirect you to payroll. The voice recording will give you options to ...